Confidence in Regional Economy Soars

Confidence in the Washington-area economy has reached its highest point since February 2009, according to the semi-annual economic survey released last week by the Greater Washington Board of Trade.

Business leaders have overall positive perceptions of current economic conditions that confirmed the outlook six months prior. They also expect the economy to keep improving, as measured by the survey’s Business Outlook Index.

“This is the highest level of economic confidence in Greater Washington’s business community since the beginning of the economic downturn” says Jim Dinegar, president and CEO of the Greater Washington Board of Trade. “Corporate executives and government officials should take special note of the significant spike in the number of business leaders who are positive about the state of the current economy.”

The survey was conducted for the Board of Trade by Clarus Research Group, a nonpartisan Washington-based research firm, and was sponsored by Tatum, a leading professional services company supporting the office of the CFO.

Click Here for More about Washington area economy

How to Franchise Your Business

Is Franchising the Right Expansion Strategy for You?

Do you think your business is unique?

Are your friends, family--and, more important, your customers--telling you every day that you should franchise your business?

They may be right.

But are you sure you really know what franchising is all about?

Is your concept really "franchiseable"?

How does one go about franchising?

What does it cost?

And do you have the skills necessary to become a successful franchisor?

In this article, we will answer these questions so that you will have a better understanding of franchising as an expansion strategy.

And while it's not the right strategy for everyone, for some companies the explosive potential that franchising affords is unparalleled in the world of business growth.

For More About Franchising Your Small Business

Google, SBA Reach Out to Small Business

Google and the U.S. Small Business Administration (SBA) have developed a set of online resources, tools, and training designed to help small business owners make themselves more visible online.

Accessible from the SBA's home page , Google's "Tools for Online Success" site currently contains nine videos. Each Google-produced video features a small-business owner speaking about a particular aspect of creating an online presence, from building a web page to conducting online promotions.

We worked together to identify small-business success stories," said Joseph Zepecki, spokesman for the U.S. Small Business Administration, in an interview. "They're telling the story of how these brick-and-mortar small businesses are succeeding online."

In addition, Google produced a 24-page booklet that will be distributed by the SBA at resource partner locations across the country, including small business development centers (SBDCs) and chapters of SCORE, an organization that matches volunteer counselors with small-business owners.

More on Google, SBA Resources

Big Banks' Small-Business Lending Promises

They said they would increase credit to small businesses in 2010. Here's a look at how some of the biggest fared in the first quarter

Are banks lending more to small businesses? It's hard to say.

What's called "small business lending" cuts across several business lines at most banks, from real estate to credit cards, and few lenders report separate figures for small businesses.

Still, late last year, under pressure from the White House to increase credit to Main Street, several of the nation's largest lenders—including Wells Fargo (WFC), Bank of America (BAC), and JPMorgan Chase (JPM)—made big promises to expand small business lending in 2010.

We asked four that set concrete targets to boost small business lending in 2010 how well they met those goals in the first quarter—two appear to be making progress; figures aren't available yet on the others.

More on Small-Business Lending in 2010

Pew Research Poll: Americans Trust Small Business

Be proud, small-business owners! You're now the most trusted group in America. Listen up, federal government! You're neglecting small business — and most people think so.

According to the just-released study by the highly respected Pew Research Center, small business is the most trusted institution in America. More than churches. More than colleges. More than technology companies. And certainly more than labor unions or large corporations.

Republicans trust us. Democrats trust us. Independents trust us. Small business isn't a partisan issue.

But we're neglected. When asked about which groups were getting too much or too little attention from the government, Americans felt small business was getting dealt the worst hand. Hey, elected officials, listen up! Small business is one of the few groups Americans want to get more government attention. Read more about Small Business Trust

Top 10 YouTube Tips for Small Businesses

Video can be a very powerful tool for businesses of any size,

but YouTube's free-to-use business model, ease of use, and mass market audience means it's a great channel for small businesses.

However, like any tool, in order to get

the most of it, it needs to be used well.

We've pulled together ten top tips to help you get the most out of YouTube.

Rather than video production hints or content tips (there are tons of other resources that can help you on that front) here are the do's and don't's of using YouTube with a "behind the scenes" perspective.

Top 10 YouTube Tips - Click Here

Forbes Magazine Ranks Best Places for Business and Careers

The Great Recession ravaged almost every big city across the United States in 2009. Home prices were down in 182 of the 200 largest metro areas, while household incomes fell in 94% of these areas. The Great Recession ravaged almost every big city across the United States in 2009. Home prices were down in 182 of the 200 largest metro areas, while household incomes fell in 94% of these areas.

The employment picture was even tougher: only four areas posted positive job growth with a paltry gain of just 4,300 positions created--combined. The other 196 metros together lost 3.5 million jobs last year.

The worst may be over, but businesses on both coasts still face outrageous costs and indebted state governments with budget shortfalls that will have to be filled from the flesh of local firms. Those problems won't be resolved anytime soon.

What to do? Our 12th annual ranking of the Best Places for Business and Careers has an answer: Move to Middle America. For the Complete Forbes Report Click Here

Should You Tell The Employees?

(from New York Times "You're The Boss - the Art of Running a Small Business")

The issue of what you tell your employees when you’re trying to sell your business is a tricky one that requires careful thought.

Maintaining confidentiality surrounding the sale typically takes precedence over other concerns, yet it may be impractical — or even impossible — to keep employees in the dark.

The most common approach is to keep information about the sale limited to as few people as possible. “The general public typically knows nothing about the small-business-for-sale marketplace because it happens below the radar,” said Rose Stabler, managing partner of Certified Business Brokers in Houston.

The primary reason for strict confidentiality is to prevent customers, vendors and employees from assuming that there is something wrong with the business and putting a successful sale at risk.

“As with the public, it is natural for employees to think negatively if they learn that the business is for sale,” said Ms. Stabler. “They may look for employment elsewhere — possibly with competitors — and then there goes confidentiality. The general rule we use is that there is nothing to gain by telling employees that the business is for sale before it is sold. ”

Read More from "The Art of Running a Small Business"

Are You an Entrepreneur?

Or a Small Business Owner?

Innovation is the wheel that keeps the business world turning. Without it, we’d be living in energy inefficient homes, driving cars that run on leaded gasoline, and wearing parkas that don’t really block wind or keep us dry in a downpour. Innovation is that little—and sometimes big—something that separates entrepreneurs from small business owners.

In this, the final of a three part series based on a conversation I had with CPA and small business consultant Jason Howell, I share with you Jason’s thoughts on entrepreneurship, which are in turn based on Peter Drucker’s writings and thoughts.

For those of you who are only vaguely familiar with Peter Drucker’s name, he was a writer, management consultant, and self-described “social ecologist.” (He passed away in November 2005.) I’ll let Wikipedia take over from here:

“He…explored how humans are organized across the business, government, and the nonprofit sectors of society. His writings have predicted many of the major developments of the late twentieth century, including privatization and decentralization; the rise of Japan to economic world power; the decisive importance of marketing, and the emergence of the information society with its necessity of lifelong learning. In 1959, Drucker coined the term “knowledge worker” and later in his life considered knowledge work productivity to be the next frontier of management”. (The hyperlinks were supplied by Wikipedia, too.)

Peter Drucker described an entrepreneur as someone who innovates. He or she looks at a product or service in a different way and reinvents it to offer something new. A small business owner, on the other hand, is simply someone who owns a business and replicates what others have done.

Read the Grow SmartBusiness article here

Washington Metro Area Job Growth Kicks In

After losing jobs in 2009, the Washington area is expected to have a net gain in jobs this year, followed by accelerated growth in following years, according to a forecast by Delta Associates.

The Washington area saw payroll employment decline by 29,200 jobs in the year ending January 2010, a 1 percent decline. That compares favorably to a national decline of 3 percent during the same period. Washington ended the year with 2.9 million payroll jobs, the fourth-largest job base among metro areas, behind New York, Los Angeles and Chicago.

Three major sectors added jobs in 2009. Government, education and health and leisure and hospitality added a combined 13,200 new jobs.

Read more about DC Area Job Growth Forecast

iPad Peek: See How Your Business Website Looks on the iPad

(from Mashable)

The iPad is finally available, and it’s already residing in the hands of some 300,000 people who purchased it on launch day. In a couple of months, the iPad user base will become big enough for web developers to start paying attention to how their websites look on the iPad.

iPad Peek is a nifty tool that lets you see how any website will be rendered on the iPad. Click on the top border to switch from landscape to portrait mode. The virtual keyboard and the buttons on the iPad browser are just for show, but the reload button works.

Previewing a website in iPad Peek doesn’t offer the “real” iPad experience, however; for example, Flash works (and it shouldn’t). To get closer to the real deal, you should disable the Flash plugin in your browser and change the user agent string to that of the Apple iPad.

To do this last bit in Firefox, type “about:config” in the address bar, click the right mouse button, select New – String, and name it “general.useragent.override”. Then enter the value “Mozilla/5.0 (iPad; U; CPU OS 3_2 like Mac OS X; en-us) AppleWebKit/531.21.10 (KHTML, like Gecko) Version/4.0.4 Mobile/7B334b Safari/531.21.10″.

More on iPad Peek Website Preview Resource

9 Big Topics

If your company’s still in survival mode — or you’re just trying to stay one step ahead of the competition — any salient idea that can help you cut expenses, streamline operations and get more out of your existing resources is useful.

Smart Business has collected the best big ideas from the regional business leaders we have featured throughout 2009 and assembled their insight, advice and strategy here.

Topics include communication, innovation, accountability, culture, and even a few tips on hiring and managing top talent. Simply put, these are big ideas in action from top executives who have put them to the test.

1. Simplify the details

2. Don’t kill your culture by stifling creativity

3. Use a guiding principle

4. Don't forget where you make your money

5. Create a vision but revise as needed

6. Figure out what your employees want

7. Address your issues quickly and honestly

8. Measure everything and hold people accountable

9. Hire doers

What You Should Know About Before You "LLC"

There is an assumed measurement of power and prestige to a business when it adds an LLC or Limited Liability Company

suffix to its business structure. But that perception actually is just a part of what incorporating a business can actually do.

Anyone can get an LLC; the paperwork is fairly simple and straightforward. Each state has an annual filing fee around $200, and Legal Zoom, for example, will do all the LLC paperwork for your small business.

But it’s a good idea to know how you can use it to your advantage, and when it actually does you and your business good.

10 Tax Breaks Every Small Business Owner Should Know About

It's tax season.

Those words usually strike dread into the hearts of everyone who hears them. And after a particularly rough year like 2009, the last thing you want to do is shell out more money.

Small business owners: cheer up!

This year, doing your taxes should be slightly less painful for many of you. Congress has recently implemented some cool tax breaks -- mainly in The American Recovery and Reinvestment Act of 2009 (a.k.a. the "Recovery Act") -- to make things a little easier on small businesses.

We spoke with Jean Baxley, a tax attorney in Washington, DC, about the latest changes.

Be sure to talk to your accountant about whether or not you qualify for these breaks! Read More from Business Insider about 10 Tax Breaks

Potomac Tech Wire hosts "Mobile Outlook 2010"

Mobile Outlook 2010 is part of the Potomac Tech Wire breakfast series that brings together senior executives in the Mid-Atlantic to discuss technology issues in a conversational, roundtable environment moderated by the editor of Potomac Tech Wire.

This panel will focus on the overall outlook and major developments in the mobile industry, including the rapid growth of mobile applications, developments in mobile advertising and content, competing mobile platforms, smartphone innovation, geo-targeting integration, and business model concepts.

Speakers include:

Kevin Bertram, CEO, Distributive Networks

Matt Jones, VP, Mobile Strategy & Operations, Gannett Digital

Maurice McKenzie, Founder and President, YadaHome

Michael Sanford, Founder and President, FlipSide5

Tom Wheeler, Managing Director, Core Capital

Moderator - Paul Sherman, Editor, Potomac Tech Wire

This event will be held at the Ritz-Carlton at Tysons Corner, VA on March 30th.

More about Potomac Tech Wire's Mobile Outlook

Where to Get a Small Business Loan

If you want to expand your business, you're going to need some cash.

Money still isn't falling off trees for small businesses, and the lending seas can be a challenge to navigate. Although you need funding, you want to make sure your deal is better than the one offered by the neighborhood loan shark.

Money might be available thanks to stimulus spending, but that doesn't mean it's easy to get.

"The [banks] have tightened their lending policies, and it is more difficult for an entrepreneur to get financing,'' says Velda Eugenias, a certified financial planner with Eugenias Advisory Group in Gadsden, Ala. "It is causing the small-business owner to have to get creative with finding sources of capital.''

Click here for more about small business lending

Keeping Business Records "In the Cloud"

Many businesses have made the switch to maintaining records electronically, but there's a step beyond simply getting all your records on your computer: putting them in the cloud.

There are many benefits to having your business records in the cloud.

You can access them from anywhere that you can find an internet connection, and you can keep your computer hardware to a minimum

However, there are some drawbacks as well — security remains a key concern for many businesses considering keeping their records in the cloud.

More on Record Keeping "In The Cloud"

Dunkin Donuts Tracking Tweeter to Turn Tweets Into Sales

Twitter's allure is tough to translate into dollars, but one national name, Dunkin' Donuts, is tracking results and ramping up its presence on the microblogging site.

Twitter represents a gold mine of marketing possibilities, but the vast majority of firms haven’t figured out how to transform those 140-character tweets into sales.

One exception is mega-brand Dunkin’ Donuts, which has started to track dollars flowing from Twitter by tallying the number of people who click through from a “Win Free Coffee for a Year Offer” on Twitter. Users who enroll in the “DD Perks” program are entered into a company database.

The company has a quantitative value for database members, although it will not disclose that number or the Twitter click-through rate.

More on Tracking Twitter - Turning Tweets Into Sales

Need Help Starting Your Business? Enter StartRight! by March 26

(from Shonali Burke, Women Grow Business)

If you work in the DC metro area, why not let REDI’s (Rockville Economic Development, Inc.) StartRight! help your business along? They’re looking for women entrepreneurs in DC/MD/VA that they can give some decent moolah to.

And all you have to do is write a business plan.

I know, there’s no “all you have to do” when it comes to writing a business plan. But it’s one of those things you know you need to do as an entrepreneur. Right?

REDI’s serious about this – but they want you to be too. So check out the information and rules here.

Executive summaries are due March 26, and final plans have to be postmarked by March 31, 2010. More information here (please check it out because we’re just passing the info along, so make sure you have the 4-1-1 right).

More Information from REDI Here

Top Government Sites for Free Business Resources

As a small business owner, having access to the right information at the right time can save not only conserve precious resources but also save you a great deal of headache and heartache.

Those looking for information on the best free government resources have many very helpful sites to choose from.

Click here for list of Free Business Resources

Podcast: Small Biz America! Where Small Business Talks

This segment features David Meadows, the founder of the United States Center for Entrepreneurship.

As a serial entrepreneur, Mr. Meadows has been the founder of businesses in publishing, software, printing and education, the largest of which now employs over 500 individuals. Mr. Meadows is passionate about assisting developing entrepreneurs and launched the United States Center for Entrepreneurship on October 1, 2009.

The United States Center for Entrepreneurship will offer “self-paced” step-by-step online classes that make starting a business easy for anyone in the world.

USCFE is great for inventors, dreamers, retirees, individuals who have lost their jobs, employees who wish to get out on their own and anyone seeking business ownership.

Click here to listen to Small Biz America! Podcast

With bank credit frozen, small U.S. businesses starting to turn to microlenders

(from Washington Post)

Ryan Fochler's life changed six years ago when he left his job in the computer industry to buy an Arlington County-based dog-walking business with $50,000 in personal savings and a home-equity line of credit. The firm grew quickly, with revenue more than doubling each year. By 2008, Fochler was ready to expand the business into a full-fledged pet day-care service called Dog Paws 'n Cat Claws.

The only problem was money.

Fochler wanted to convert an old drugstore into a 7,000-square-foot paradise for pets, complete with retail products and dog training. But those plans collided with the most severe financial crisis in a generation, and credit froze up. At one point, Fochler said, his bank refused to release the money needed to complete the construction.

"We just kind of hit it at completely the wrong time," he said. But, he added, for entrepreneurs, "failing is not an option."

Click here to learn about Small Business Microloans

More Evidence Recovery is Underway

This is still a down economy, however, CEOs are emerging from recession mode and are making preparations for recovery according to the most recent CEO Challenge Survey.

Some of the main issues/challenges that CEOs are focusing on this year are:

- Customer loyalty/retention

- Reputation for quality products/services

- Innovation/creativity

- Sustained and steady top-line growth

Linda Barrington, Managing Director of Human Capital at The Conference Board, noted “CEOs’ focus on these challenges suggests that recession-weary customers need to be wooed with significant new value to win back their business.”

And, wooing customers is exactly what some small business owners intend to do. According to Forbes Insight’s and CIT’s 2010 survey of 220 small business owners, 78% of executives and small business owners believe the old way of doing business won’t work in today’s economic environment and they need to find new ways to take advantage of opportunities. In addition, more than three-fifths of small businesses said they will invest more in marketing and advertising in 2010. Read More About CEO's Plans Moving Forward

Hiring by Smallest Employers May Signal Job Recovery

(from BusinessWeek)

While forecasters expect the Labor Dept. report due out Mar. 5 to show that the U.S. economy is still shedding jobs, data from payroll companies suggest that losses at the smallest businesses have stopped and those businesses are beginning to hire.

Companies with less than 20 employees have been tentatively adding new jobs since June 2009, according to a new index by Intuit (INTU) released Mar. 1, based on data from 50,000 customers of the software maker's online payroll service.

At the same time, a two-year slide in the average paycheck for workers at businesses with fewer than 100 employees has stabilized since December, according to data published Mar. 3 by SurePayroll. The average paycheck broadly reflects the number of hours employees worked. (Both Intuit and SurePayroll's data include salary, hourly, and contract workers.)

Brian Headd, an economist in the Small Business Administration's Office of Advocacy, says it's "definitely possible" that small businesses are now adding workers, even as net job losses in the economy as a whole persist.

In a paper released Mar. 3, Headd notes that companies with fewer than 20 employees began creating new jobs in the 2002 recovery even as larger businesses continued to lose jobs. Companies with fewer than 20 employees make up 89% of all employer businesses and employ 18% of the private workforce, according to the latest Census data, from 2006.

Click here for more on Small Business Job Creation

What States and Cities are Doing

to Help Small Businesses

(from the New York Times)

While Washington debates how to help the country’s struggling small businesses, states and municipalities have stepped up with an array of initiatives to stanch closings and save jobs.

The local approaches are as varied as subsidizing wages for new hires, running a $100,000 regional business-plan competition and giving out grants to help small manufacturers reposition

themselves.

Some states and cities are using federal stimulus dollars, and others are mixing federal, state and private dollars.

Click Here for More onLocal Help for Small Businesses

The Most Important Thing for New Entrepreneurs to Understand

(by Joe Hall on March 3, 2010)

What follows is a collaborative interview including some of the biggest minds in marketing online and off.

I will admit that I am rather shocked at the folks that agreed to participate in this interview! But I am humbled and extremely gracious for their contribution.

I hope to do more interviews like this one that includes other amazing people across the spectrum.

Click Here for the complete Questions/Answers article

8(a) Workshop Seminar Series Begins March 9

On Tuesday, March 9th the FCEDA will be holding"8(a) Contracting and JV/Mentor-Protege Programs", the first in a yearlong series of workshops designed to explore opportunities in the Small Business Administration's 8(a) program.

The 8(a) Program is the US Small Business Administration's effort to promote equal access for socially and economically disadvantaged individuals to participate in the business sector of the nation's economy.

Socially and economically disadvantaged individuals represent a significant percentage of U.S. citizens yet account for a disproportionately small percentage of total U.S. business revenues.

The program recognizes the historical lack of equal access that minorities and other disadvantaged individuals have had to the resources needed to develop their small businesses.

The program assists 8(a) approved firms to participate in the business sector and to become independently competitive in the marketplace.

The workshop series, which runs March through November 2010, will be held at Fairfax County Economic Devleopment Authority headquarters (map) in Tysons Corner (VA). The workshop presenters will include attorneys, bankers, SCORE representatives and business owners who have led their companies through all phases of the 8(a) program.

Click Here for More Information and Registration

Are You On LinkedIn?

Powerful Business Networking Site

LinkedIn is the most powerful social networking site to help you grow your business. It makes Twitter, Facebook and YouTube seem like social networking sites for kids.

If you want to hang with the big players—a place where connections are made, leads are generated, and deals go down—then you need to spend more of your time on LinkedIn.

Although other sites have their purpose in the business world and many people utilize multiple social networking sites, LinkedIn is still the number-one place to market your business.

Top 5 ways to market your business on LinkedIn

Connect with Bay Business Advisors on LinkedIn

Six Cold Truths about Building

Your Business in 2010

(by Liz Strauss)

Strategy and new business is all focus and knowing the cold truth.

My business client said some thing like,

“I’m having so much fun figuring out Twitter. It’s hard to know that I’m doing the right things with my time.” I suggested he Google, “I’m addicted to Twitter” to see that he’s not alone.

Part of the Internet addiction is the lovely relationships and community that it brings to us.

Keeping that going can be very alluring, even when it takes our time and focus away things that might be earning.

Managing time and ourselves as we build and manage our relationships is crucial to surviving and thriving as a business.

Until you know and feel your focus as an Internet citizen, review these these cold truths often. Click Here for the 6 Cold Truths -->

Daily Sources of Online Inspiration

Every time you launch Tweetdeck or HootSuite (or whatever application you’ve chosen for managing your Twitter stream) you will probably find at least one new resource to add to your bookmarks bar.

Twitter makes it simple to stumble upon a treasure trove of professional goodness, but it can be difficult to manage and make use of it all.

Build a list of bookmark-worthy websites that have the potential to carve a spot into your browser toolbar.

Not just helpful, but rather those sites you can’t get through your day without – your daily nourishment if you will. The good stuff that really inspires you and has truly earned a spot in your top bookmarks.

To get started, let's look at the Top 5 Social Media/Web 2.0/Marketing sites and the Top 5 Small Business Hubs.

Read More About Daily Entrepreneurial Nourishment

Should YOU Be An Entrepreneur? Take This Test

(by David Isenberg - Harvard Business Review)

Some of your friends are doing it.

People who do it are in the front pages and web almost every day.

Even President Obama is talking about it.

So should you do it? Should you join the millions of people every year who take the plunge and start their first ventures?

I've learned in my own years as an entrepreneur — and now an entrepreneurship professor — that there is a gut level "fit" for people who are potential entrepreneurs. There are strong internal drivers that compel people to create their own business.

I've developed a 2–minute Isenberg Entrepreneur Test, below, to help you find out.

Click here to take the Entrepreneur Test

Tips for Negotiating with a Potential Landlord

(from Open Forum)

Finding the right space for your business is an exercise in negotiation: assuming you're not ready to purchase a commercial property, you're probably looking at renting an office or a work space.

Not only do you have to find a space that will provide you with the location and tools to grow your business, but you also have to convince the landlord to give it to you at a price you can afford.

On the surface, it may not seem that renting office space offers a lot of room for negotiation. You look for rentals in your price range, tour the property with the landlord or manager, and sign a lease for the amount advertised.

The truth, though, is that even if you're talking to a management company that can't negotiate on price, there are many opportunities to make your lease a more equitable contract.

From exactly what expenses your rent covers to how far the landlord will go to prepare the unit for you, you have an opportunity to negotiate each step of the lease.

Read More about Lease Negotiations at Open Forum

The 4th Annual Southeast Venture Conference (SVEC) -February 24 and 25 Tysons Corner VA

The 4th Annual Southeast Venture Conference will showcase the most promising high growth technology companies in the Southeast region to a national audience of hundreds of private equity professionals and venture capitalists.

Join the 2010 Southeast Venture Conference in hosting some of the most dynamic high-growth companies in the Southeast, Feb 24-25, 2010 at the Ritz Carlton in Tysons Corner, Virginia.

The Fourth Annual Southeast Venture Conference will feature market relevant investor and executive panels, exclusive networking opportunities, featured speakers and dozens of the region's top private technology firms presenting to a national audience of venture capitalists, investment bankers and private equity investors.

The Southeast Venture Conference highlights both early stage and later stage investment opportunities from: Alabama, Florida, Georgia, Maryland, Mississippi, North Carolina, South Carolina, Tennessee, Virginia and Washington DC.

Read More Here -->

Use Marketing to Stay Strong in a Weak Economy

Shrewed Business Owners See Opportunity in a Down Market (from Entrepreneur)

Today's companies face the challenge of marketing in an economic state of turbulence and uncertainty. The key to maintaining forward momentum in today's market is to resolve to be competitive and shift to an opportunistic mind-set.

Rather than focusing on the turbulence, your company should leverage the dynamics of a down market and become an even stronger competitor. A weak economy can actually serve as an opportunity to evaluate your marketing and public relations initiatives so you can make them more effective and efficient.

In good times, it's easy to get into the proverbial marketing rut; some companies have been marketing themselves the same way for years, using the same old marketing plan year after year. But when you're forced to scrutinize every expenditure, suddenly a new zest for change can emerge.

Let this weak economy empower your company to find fresh, creative ways to remain visible, stand out as a distinctive brand and be the leader in your category--even on a smaller marketing budget.

Read More about Small Business Marketing

Take Steps to Minimize the Pain of

Small Business Taxes

As we turned the corner into the New Year, that meant the start of the clock for tax filing season. Small business owners complain a lot about taxes. But the issue is typically about all of the filing requirements – all the things you have to do that give you major heartburn.

There are so many tax related activities required for small business that the IRS publishes a small business tax calendar every year. It’s a really useful tool that is normally released during the fourth quarter of the year.

Although it’s out of stock now, you can still view a handy interactive copy of the tax calendar online.

Since taxes are top of mind right now, two tax professionals, Suzette Flemming, President of Flemming Business Services Inc., and Kay Bell, Tax Journalist and author of The Truth About Paying Fewer Taxes, offer their thoughts on the key obstacles for small business owners (i.e. where they take some missteps and what they should do about it).

Read More About Small Business Tax Tips Here

How to Create a Small Business Advisory Board

Jim Bourdon, chief executive of Accounting Management Solutions in Waltham, Mass., said his advisory board persuaded him to be more aggressive about jettisoning ineffective consultants and replacing them with star performers. The result? His clients report that his company’s consultants are either meeting or exceeding the standards set by Mr. Bourdon and his team.

Other business owners credit their advisory boards with cutting costs; helping with product development; introducing them to valuable clients, investors, and suppliers; and eliminating the sense of isolation that can come with running your own business. Most crucial, an advisory board makes a chief executive answerable to a third party

Read more about Small Business Advisory Board Benefits

The DRIVE Interview:

5 Questions with Daniel Pink

by Matthew E. May

(Feb 12, 2010)

I recently finished reading Drive: The Surprising Truth About What Motivates Us, by Daniel Pink.

I’ve been a fan of Dan’s writing for over a decade. His bestselling book, A Whole New Mind: Why Right-Brainers Will Rule the Future, is probably the first widely read and accepted take on design thinking, and it’s required reading for an advanced MBA course I teach on creativity and innovation in organizations.

In his new book, Dan synthesizes reams of scientific research on human motivation and concludes that there’s a significant disconnect between what science knows and what business does.

I had the opportunity to ask Dan a handful of questions about Drive, and what he terms “Motivation 3.0.”

Read "The DRIVE Interview" here

Six Tips to Supercharge Your Effectiveness on Twitter

Twitter offers various business advantages. It is a fact that companies offering market analysis services and softwares charge dearly for such things.

Very small numbers of people actually know that Twitter can provide a wealth of marketing knowledge and market analysis for free. The only thing required to gain this wealth is by knowing the right way to extract it from Twitter.

The most astounding thing about Twitter is that it offers results in real-time. This real time result helps you gain a snapshot of how people are reacting towards a certain product category or towards a certain market.

This information comes in very handy when your business is in a competitive niche where people change their tastes and opinions in a moment’s notice.

The only way to survive and be profitable in such a niche is by staying ahead of your competitors and by knowing what the consumer demands at present.

Read More About the Business Advantages of Twitter

Top Ten Web Tools for Business Collaboration

Collaboration is more and more important as a way to work these days, especially if you’re using remote workers, outsourcing or allowing some employees to work from home. How do you sort through all the collaboration tools that are available?

Business Pundit recently spotlighted a list of 10 Best Collaborative Web Tools for Business. While not all of these tools are suitable for small companies, many are worth taking a look at.

Click here for more on Collaboration Web Tools

Credit Unions Seek Larger Share of

Business Loans

The names of small businesses seeking loans are scrawled across a whiteboard in the Bethesda offices of Mid-Atlantic Financial Partners: A Denny's franchisee with plans for a new restaurant, the owner of a limousine fleet hoping to consolidate his auto loans, a government contractor seeking a line of credit to fund expansion, the owners of a medical office building in Leesburg looking for a mortgage.

Most of the businesses came here after their requests for financing were rejected by one or more banks. Mid-Atlantic is not a bank: It is mostly owned and funded by a local credit union, Mid-Atlantic Federal Credit Union. And at a time when banks are making fewer business loans, Mid-Atlantic is expanding dramatically, lending $32 million to small businesses last year and planning to lend $50 million this year. Click here for more on credit union lending

Landrieu Praises Treasury's New Community Lending Program for Small Businesses

Washington (PRESS RELEASE – February 9, 2010) — Senate Committee on Small Business and Entrepreneurship Chair Mary L. Landrieu, D-La., who has shepherded small business job-creation measures through her Committee, made the following comment in regard to Treasury Secretary Timothy Geithner’s unveiling of the $30 billion Small Business Lending Fund, a fund that directs money to community banks for small business lending:

“Now that we have invested in Wall Street, it is time to jumpstart Main Street. Small businesses have borne the brunt of these tough economic times, but they are the businesses that have the greatest potential to get our economy going again. The first and fastest way to boost our small businesses’ ability to create jobs is by giving them greater access to capital. Providing money to neighborhood banks to lend to small businesses is a quick way to jumpstart our communities by investing in both our small banks and small businesses. With the Small Business Lending Fund, community banks will have the resources they need to give small businesses the tools to continue growing our economy. I look forward to working with the Administration on implementing a program that provides small businesses the capital they need, including initiatives to increase SBA loan sizes and extend SBA provisions from the Recovery Act.”

Click Here For More Information on the

Community Lending Program

(.pdf file)

Top Ten Tax Tips for Small and Growing Businesses

Taxes are one of the most important issues facing small and growing businesses. And like a company's profits, its annual tax bill will in part reflect the owner's skills and knowledge.

Business owners need to be sure that they are meeting all of their responsibilities to the tax man -- and also seizing every opportunity to reduce their taxes. These tax tips will ensure Uncle Sam is not getting more than his due.

Click Here for the Top Ten Tax Tips -->

Considering a Facebook Group or Fan Page?

Before you start, think carefully about the name of your page. John Haydon's quick video tutorial points out why your choice matters so much.

Click Here for John Haydon's Facebook Tutorial

Banks Urged to Increase Lending to Small Businesses to Encourage Economic Recovery

Regulators are urging banks to make loans to creditworthy small businesses, a move that would support the economic recovery.

Small businesses have had an especially hard time getting loans.

That has crimped their ability to expand operations and hire. Small businesses usually help drive job creation during recoveries, but credit clogs have hurt hiring.

In a joint statement Friday, regulators including the Federal Reserve, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency — said that banks that engage in "prudent small business lending after performing a comprehensive review of a borrower's financial condition will not be subject to supervisory criticism for small-business loans made on that basis."

Read More about Small Business Lending Here

Treasury Dept Launches Program to Spur

Small Business Lending

The Treasury Department said Wednesday that it would use as much as $1 billion from the Troubled Asset Relief Program to spur lending to small businesses in lower-income areas.

Under the initiative, banks, thrifts or credit unions that are certified by the Treasury as community development financial institutions can apply for capital injections.

CDFI firms are set up to invest in urban and rural areas marked by poverty and often not served by traditional banks.

Read More About Troubled Asset Relief Program (TARP) Here

How Businesses Can "Share" and Become "Social" in Social Media

by Neal Schaffer, Windmill Networking

With all of the talk about how companies need to get more “social,” all I see are a barrage of new “Follow Us on Twitter” or “Join Our Facebook Fan Page” advertisements.

As someone who uses Social Media for 1) keeping in contact with old friends and colleagues, 2) professional networking and meeting new people, and 3) finding valuable information and learning, I really have no reason to be joining Facebook Fan Pages of businesses unless they satisfy one of my requirements. Remember: social media was created for average people like you and me, not businesses.

Another aspect about Social Media is, at the end of the day, it’s all about sharing. Those who share relevant information on LinkedIn, Twitter or Facebook will naturally stay on top of people’s minds, and they will also win a lot of new “friends,” “followers,” or “connections.” So, as a business, what will you share? Are you just going to blast us with your press releases on your Twitter feed or Facebook Fan Page? This is no different than average users spamming others with MLM schemes.

I find that there are two big trends appearing in how businesses approach the “sharing” part of social media...

Read More About Social Media and Business Here -->

Hints of Improvement in Small Business Economy

Posted by: Nick Leiber on February 02

Now for some good news. The small business economy is finally showing hints of improvement, according to William Phelan, the co-founder and CEO of commercial lending data provider PayNet, which collects loan information from several hundred capital equipment lenders around the country on a monthly basis.

During a meeting this morning at Bloomberg’s New York offices, Phelan said his company’s small business lending index showed defaults by private companies on term loans of $1 million or less fell for the first time in two years this December.

He thinks this is significant because until this November double-digit default rates had been the norm. Phelan said small business owners were starting their “gradual march to expansion,” though demand for loans this December was down 39% compared to December 2006.

More from Business Week "Small Business" -->

3 Tips for Masterful Decision-Making

Whether you believe in making decisions swiftly and decisively or with more caution and deliberation, try these three tips to help you reach better conclusions and avoid decision-traps:

Read More from Harvard Business Review --->

Entrepreneurs Have Enthusiasm in Common

USA TODAY is launching a six-month series following the progress of several entrepreneurs who are starting new businesses.

Experts say the entrepreneurs behind the wine business, peanut sellers, home inspector, Botox provider and high-end property rental firm that were selected from among 1,800 applicants to the Small Business Challenge have one thing in common: enthusiasm.

More About USA Today Series -->

Why Start-Ups Need Capital Discipline

Since more often than not, a startup’s model and/or product will change from the point of founding and funding, early-stage startups need to the ability to make informed progress in the face of all challenges.

How capital flows into and out of a startup in order to enable such progress is absolutely critical and yet very difficult to manage.

And execution in the presence of too much capital, too little capital, or poorly applied capital defines both the health of the business and the relationship between a startup and its investors.

Together, the concepts of slow capital and capital discipline provide a framework for managing this relationship.

Read More About Start-Ups & Capital Discipline Here

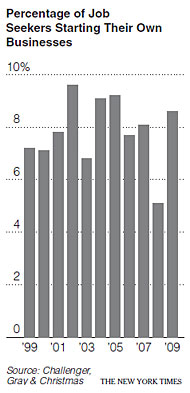

Finding A Job By Buying A Business

NY Times

Last year, more laid-off managers and executives grew tired of waiting for human resources departments to call them back. They took matters into their own hands by starting companies.

Challenger, Gray & Christmas, the outplacement firm, regularly keeps track of 3,000 high-level job seekers in a range of industries. Last year, 8.6 percent of these decided to take the start-up route, compared with 5.1 percent in 2008.

The biggest surge was in the third quarter. The hope is that this momentum “will carry into 2010, since new business development is considered critical to a sustainable recovery,” Challenger stated. More on

"Laid Off Managers Starting Their Own Businesses"

U.S. Economy Soars in 4th Quarter 2009

The U.S. economy roared ahead in the final months of 2009, growing at its fastest rate in six years, as corporate America stopped slashing its inventories and again started to invest for the future.

Gross domestic product, the broadest measure of economic activity, rose at a 5.7 percent annual rate in the fourth quarter, the Commerce Department said Friday.

That is the highest pace of growth since 2003, and it constitutes strong proof that the recession reached its end earlier in 2009. It was also a surprisingly positive result, well above the 4.6 percent rate of GDP growth forecasters had expected.

Read More Here --->

A Different Take on the "Innovation Economy"

It's pretty firmly established that small businesses are the nation's innovators.

We know this because of the research that find small patent-holding firms are roughly 13 times more innovative per employee than large patent-holding firms, according to a 2009 research report published by the U.S. Small Business Administration, Office of Advocacy.

They tend to be more technically important and otherwise outperform large firm patents on a variety of different metrics. This is another reason why small businesses are so critical to the U.S. economy, which thrives on new and disruptive technologies.

Read More at "Open Forum" --->

Timing the Sale of Your Business

A recent report published by BizBuySell — one of the Internet’s largest marketplaces for buying or selling a small business — confirmed a hunch I’ve had for several months, namely that small business deals seemed to pick up during the latter part of 2009.

While many business owners have put their exit plans on hold until the economy recovers, others are not only hanging on but enjoying growth and have a bright outlook for 2010.

The New York Times published two retrospective articles in December — one featuring small businesses that managed to grow in 2009 and one on businesses that had to close.

In the latter article, by Ian Mount, business owners were asked to look back on their experiences. One owner’s response was that she should have sold her business when she had the chance.

Read More About Exit Strategies -->

More People Considering Their Own Business?

A recent study by the SBA found that when unemployment is high, the number of sole proprietorships goes up. Some people who are laid off from their jobs decide to start small businesses.

If you find yourself in such circumstances -- out of a job and thinking about starting a business -- chances are you won't have much money to start up with.

So here are 10 businesses with potential for growth in 2010 and beyond that require little startup capital.

Read More Here --->

2010 Tax Law Changes Affecting Small Businesses

The 2010 tax year also brings with it several changes to business tax law.

Tax laws often define and support your small business investment and growth strategies. So, it's important to take stock now, and assess how your business can comply with, and benefit from the changes that apply to the 2010 tax year.

Read More Here -->

Ten Small Business Trends... and Opportunities

What are some of the key trends affecting small businesses?

And more importantly, what do these trends mean and what kind of opportunities will they lead to for your business?

These are the questions answered in a recent webinar hosted for the Intuit Community.

Anita Campbell and Ivana Taylor discussed 10 trends affecting large groups of small businesses.

Click here for a summary of the 10 trends --->

Small Business Owners Get Creative;Take Risks to Survive Slow Economic Times

Brooklyn's mom-and-pop shops aren't taking this recession lying down.

Some of the borough's small businesses are managing to survive - and even thrive - the tough times through good planning, savvy investing and marketing - and plain old luck.

That doesn't mean it's easy.

Read More Here --->

Get Mobile Now

“What trends or predictions do you believe will prevail? How can we be visionaries in a space as dynamic as social media?” The answer? Get mobile now."

"From the incredible outpouring of donations for Haiti to the ongoing Android/Apple wars, this is the year of mobile. Fifty-five percent of Americans connect to the Internet wirelessly, says the Pew Internet & American Life Project. If you want to be a visionary, a leader in this space, then own mobile media."

"In my mind, we’re at a similar place of adoption as social media in 2006 or 2007. Rather than trying to establish visionary leadership in an overcrowded market, it makes sense to become a master of this next generation of portable Internet media. It’s much easier to lead in a greenfield space than to overcome very strong leaders in the existing social media marketplace."

Read More Here --->

For more about the Social Media Club DC amd the Social Media Breakfast series, visit their website at www.wordpress.smcdc.com.

Improve Your Chances for A Loan

In this Detroit Free Press article, Susan Tompor points out

• Small Business Administration loans are among the few avenues out there now for certain small businesses. www.sba.gov.

• If you qualify, SBA loans typically require a smaller down payment and lowe monthly payments..

• Make 2010 the year to repair your balance sheet. Pay down debt and save more.

• Pay attention to your credit and get a free credit report via www.annualcreditreport.com.

Read More Here--->

How Small Businesses Can Avoid a Tax Time Train Wreck

"For some small-business owners, income tax filing season feels like a slow-motion train wreck.

These are often owners who tend to be disorganized and unable to keep good records. Instead of keeping their companies' books with a small-business accounting program, they use a stack of overstuffed file folders or worse, boxes and shopping bags. They often end up spending hundreds of extra dollars paying their accountants to sort through the whole mess — provided the accountants will even agree to deal with it."

Read More Here --->

Successful "Electric Sunday" Program Expands to Include Fluorescent Light Recycling

The Fairfax County Solid Waste Management Program, in partnership with Covanta Energy, Inc., is preparing to expand the “Electric Sundays” recycling program in 2010. These events will now offer residents an opportunity to recycle fluorescent light bulbs and tubes in addition to televisions, computers and peripheral electronic devices including keyboards, speakers, keyboards, printers, scanners, etc.

Read More Here-->>

Telecommuting Trends

Results from a recent CompTIA survey on telecommuting trends.

Two-hundred and twelve professionals in IT and other industries were surveyed. The results validate that telecommuting is a viable option for organizations.

More than three-quarters (78%) of respondents work at organizations where some employees telecommute at least part time. The job role of IT Management holds the largest percent of those currently telecommuting (41%). Other top roles telecommuting include Field Technical Support (37%), Administration (35%), Executive Management (32%), and PC/Technical Help Desk (32%).

The most significant benefit of telecommuting to organizations is improved productivity, as indicated by two-thirds of respondents. Other top benefits being realized include cost savings (59%), access to more qualified staff (39%), improved employee retention (37%), and improved employee health (25%). Securing corporate information systems is the most significant challenge of telecommuting to organizations (53%).

Other top challenges experienced are limiting use of unauthorized and unsupported devices (38%), and controlling personal use of corporate mobile assets (33%). And measures that organizations have taken to meet these challenges include upgrades in network circuits, VPN equipment, VIP (Verified Identity Pass) client software, expanded security and implementation of new virtualization technologies.

For more information on this and other studies, please visit www.comptia.org/research.

Maryland ranked 2nd as best to succeed in info age, Virginia is 6th

August 11, 2008 SAN DIEGO, CA -

The Milken Institute's "2008 State Technology and Science Index ranked Maryland #2 and Virginia #6 on its list of the top ten states in the best position to succeed in the technology-driven information age.

Maryland moved up from fourth in this year’s ranking, thanks to strong positions across the many indicators used by the Institute. In particular, the report cited an improvement in the ability to attract business into the state and new projects that link research institutions with industry to produce the most advanced products.

Massachusetts, which just passed a $1-billion life sciences bill to invest in high-tech infrastructure and research and development over the next 10 years, is in the best position of any state to achieve high-quality economic growth thanks to its vast array of technology and science assets, the study says.

According to the report, regional competition for technology industries has increased since the last release of the Index in 2004. Not only are states vying with each other for human capital and resources, but countries like China and India are increasing the competition on a global level.

“States that have a vision and a plan for building and retaining high-wage jobs and viable industries are finding ways to invest in their science and technology assets,” said Ross DeVol, director of Regional Economics at the Milken Institute, and lead author of the study.

“The changes in this year’s Index give a good measure of who is ahead in the increasing competition for scarce human capital and other resources needed for a successful industry.”

The states in the best position to succeed in the technology-led information age are (with 2004 rankings):

1) Massachusetts (1)

2) Maryland (4)

3) Colorado (3)

4) California (2)

5) Washington (6)

6) Virginia (5)

7) Connecticut (10)

8) Utah (9)

9) New Hampshire (12)

10) Rhode Island (11)

On the Web: www.milkeninstitute.com

Beyond the Home Equity Loan -

Solid Financing Options

by Richard Stopa, Bay Business Brokers

Several years ago most small businesses were being purchased with home equity loans. With little cash up front, buyers were able to borrow all the money they needed to purchase a business.

How times have changed!

Over the last year, we at Bay Business Brokers have seen very little home equity loans being used to finance businesses.

Then how are businesses being financed these days?

A combination of:

1. Cash

2. Loans from Small Business Administration (www.sba.gov)*

3. "Seller Note" - and short term financing provided by the seller, a promissory note with structured payment terms and interest

4. Home Equity Loans

The business deal can also be structured and financed to allow for an "earn-out", where consideration is paid to the seller only upon the achievement of future performance hurdles of the business after the buyer takes over the business.

Buyers are generating cash to be used for down payments to purchase a business in creative ways as well. Financial companies are now offering opportunities for buyers to use their 401K money (without fear of tax penalties) .

Keep in mind there is no such thing as a "typical deal" even when home equity loans were the primary source of small business financing.

Please call or contact us at Bay Business Brokers so we can help you with either selling or buying your business. Also, we would be pleased to meet with you and your CPA, attorney or financial planner to assist you in this process.

* Established by Congress in 1953, this independent federal agency provides financial assistance in the form of loan guarantees thus making it easy for many lenders to make loans to new and growing businesses.

Keep Tabs on Your Profitablity

by Robert C DeMarzo, ChannelWeb/VARBusiness

There's a powerful yet simple television announcement popularized in the '70s that implores parents to keep close tabs on their kids by using the line, "It's 10 o'clock. Do you know where your children are?" It's a great line and is hopefully effective at motivating parents to keep closer tabs on their children. Well, I would like to modify that statement for the channel right now: "It's June, do you know where your profitability is coming from?"

Click here for the full Profitability Article...

Encouraging Economic Outlook for

Washington DC Metro area

from PNC Bank

"Economic growth in the Washington metro are will cool substantially this year as the U.S. economy slides into recession."

"However, the area's broadening array of private-sector economic drivers is expected to keep job creation positive for the year."

"The area's highly skilled workforce, strong tourism industry, a growing cluster of technology and life sciences industries, and healthy demographic trends form a foundation for solid growth over the long term that will provide some buffer against the vagaries of federal spending."

These statements are made in an Washington DC economic outlook report prepared by PNC Bank.

John Baier of PNC Bank is one of Bay Business Advisors trusted financial partners.

You may find this information of interest as you make business decisions in the upcoming months.

Click here for the full PNC Report...

|